New data shows that low-income households overwhelmingly used their expanded Child Tax Credit payments to cover basic needs like food, utilities, and rent.

The data — published last month by the Annie E. Casey Foundation — reveals that as the pandemic has dragged on, households spent more of their CTC payments on basic needs, and were less likely to save or pay down debts.

What is the Expanded Child Tax Credit?

With millions of families with children facing hardship during the height of the COVID-19 pandemic, Congress expanded the CTC last year to help struggling families with children get through the economic crisis.

When Congress passed President Biden’s American Rescue Plan in March 2021, it included an expansion of the CTC. This was seen as one way to directly help families hard-hit by the pandemic.

The expanded CTC provided $3,600 per child under age 6, and $3,000 per child age 6-17. The amount of the credit is gradually reduced for singles earning $75,000 or couples earning $150,000.

The CTC is refundable. If the taxpayer does not owe the government taxes, the government returns the excess credit as a refund.

Families that qualify for the full credit could receive monthly payments. The payments could be stretched from July, 2021 through the end of December, 2021 when the expanded CTC was set to expire. Congress failed to renew the expanded credit before the end of December.

In addition to stimulus checks, emergency rental assistance, and other pandemic relief, the CTC helped millions of low-income renters keep up with their rent and other basic household bills.

Basic Needs the Focus of Family Spending

About 6-in-10 households with children received the CTC from July, 2021 through January, 2022. The share of families with children receiving the credit varied from state to state. It ranged from 51% in California, to a high of 70% in Iowa and South Dakota.

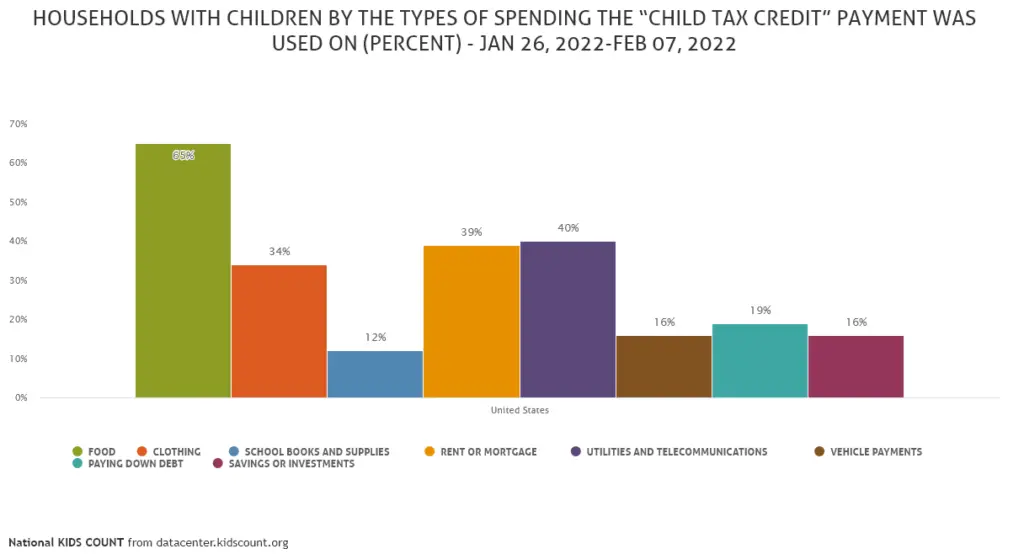

The data show that families who received the CTC overwhelmingly used it to pay for basic necessities. These households used their monthly payments to buy food, pay utilities, make the rent or mortgage, or buy clothes for their kids.

Among households receiving CTC payments:

- 65% used the money to buy food.

- 40% used the money for utilities or telecommunications.

- 39% used the money to pay the rent or mortgage.

- 34% used the money to buy clothing.

Families spent more and saved less as the pandemic dragged on

As the pandemic wore on, more households spent their CTC payments on necessities, especially food. The share of families spending their CTC payments on food jumped from 48% at the start of the credit to 65% by December.

Families also shifted how they were using their CTC payments as they faced greater needs during the pandemic. The share of families that mostly spent their CTC payments jumped from 28% in August to 40% in December.

There was also a steep drop in families who saved their CTC payments “for a rainy day,” and a slight drop in those who used it to pay down debt. The share of families who mostly saved their CTC payments dropped from 32% early on to 23% in December.

The CTC provided a critical lifeline that helped keep millions of children out of poverty and in their homes. Low-income households have had to clean out their savings and borrow heavily from family and friends to make ends meet. The monthly CTC payments, along with other pandemic relief, took pressure off of these family support networks.

Why not make the CTC permanent and lift millions of kids out of poverty?

Making the CTC permanent would lift millions of children out of poverty. According to the Center on Budget and Policy Priorities, making the CTC changes permanent would reduce child poverty by 40%.

Congressional Democrats originally proposed making the CTC permanent in their Build Back Better Act proposal. This is the bill that also had $150 billion in new affordable housing funds, including $25 billion for 300,000 new Section 8 Housing Choice Vouchers.

Democrats are still negotiating a social spending package they can pass through a process called “budget reconciliation.” This process allows them to pass spending bills with a simple majority in the Senate, so they will not need any Republican votes. Because the Senate is split 50-50, though, they need every Democrat to support the final package.

Unfortunately, the CTC’s permanent extension was dropped from the Senate version of the bill. Moderate Democrats, especially Senators Joe Manchin (D-WV) and Kirsten Sinema (D-AZ), objected to the high price tag. Manchin also wanted to increase the income restrictions and impose work requirements on those who received the CTC.

But the Casey Foundation data show that the expanded CTC had a huge impact on low-income families. Struggling families used the credit to put food on the table and keep a roof over their heads.

By not making the expanded CTC permanent, Congress missed an historic opportunity to keep millions of children from growing up in poverty.