A widening gap between wages and the price of rental housing across the United States was found in a research report published last week.

The annual report from the National Low Income Housing Coalition (NLIHC), called Out of Reach 2023: The High Cost of Housing, examines the affordability challenges faced by low-income renters as they face rising rent costs.

The findings highlight how the COVID-19 pandemic, coupled with the termination of pandemic-era benefits, has further worsened housing instability. This has led to increased eviction rates and homelessness in certain communities.

Despite a slowdown in rent growth, the NLIHC report emphasizes the trend of housing costs outpacing income growth, which makes affordable housing unattainable for many low-income renters.

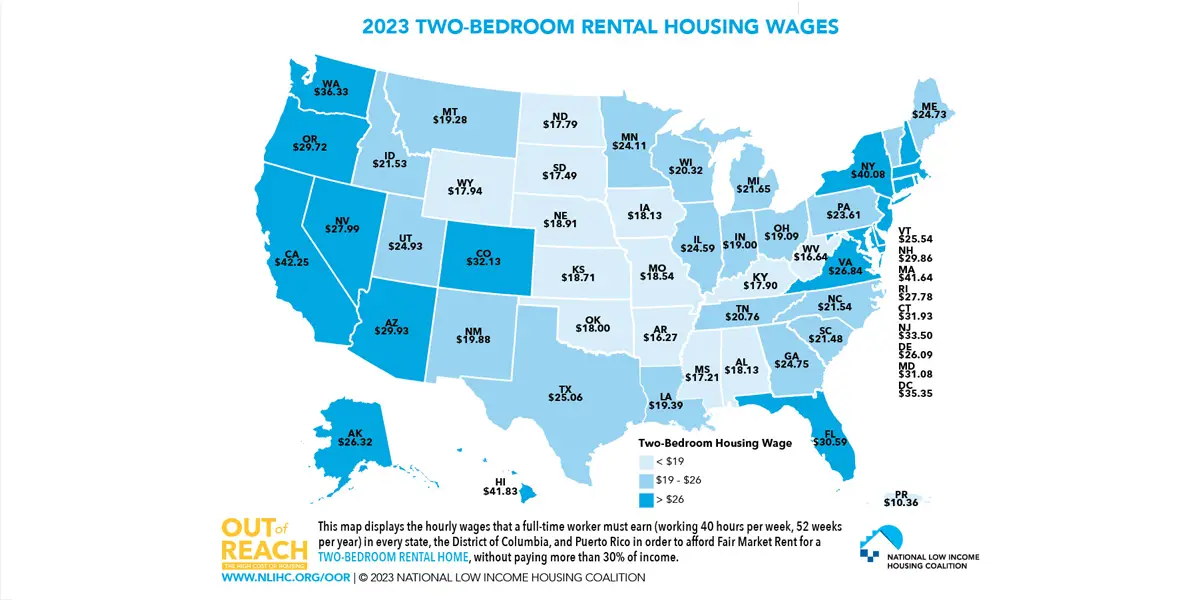

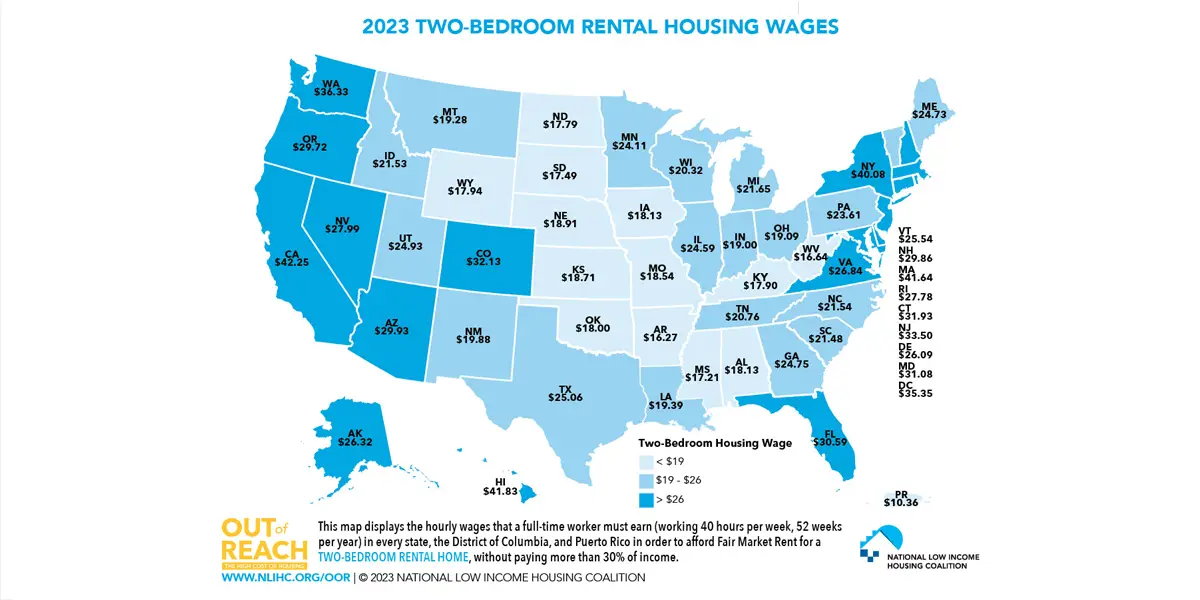

The report uses a metric called the “Housing Wage,” which represents the hourly wage needed for full-time workers to afford a rental home at fair market rent, without exceeding 30% of their income. Nationally, the 2023 Housing Wage stands at $28.58 per hour for a modest two-bedroom rental and $23.67 for a modest one-bedroom rental.

Furthermore, the research highlights the significant wage differences across states and metropolitan areas. It reveals that the average Housing Wage for a two-bedroom apartment ranges from $16.27 in Arkansas, to $42.25 in California. According to the report, a full-time minimum-wage worker cannot afford a modest two-bedroom rental home in any state, metropolitan area, or county.

The NLIHC report also details racial disparities in the housing market, as it disproportionately impacts people of color, and especially women of color. According to the study, Black, Latino, and Native American workers are more likely to be employed in lower-paying sectors, while white workers are more likely to hold higher-paying positions.

In response to the report’s findings, NLIHC and its partners urge Congress to address the far-reaching issues that low-income renters encounter in their search for stable and affordable housing.

House Republicans seek HUD cuts after agreement to keep funding level

Republicans in the U.S. House of Representatives proposed more than $22.12 billion in cuts last week to HUD rental assistance, homelessness assistance, and community development programs in Fiscal Year 2024.

Although a deal was already made to keep FY24 spending the same level as FY23, Republicans want to further reduce funding to the Transportation, Housing, and Urban Development (THUD) bill.

These proposed cuts are expected to cause hardship to many low-income renters. predicted to exacerbate poverty and hardship. “The reduced funding scenarios would represent the most devastating impacts in HUD’s history,” said HUD Secretary Marcia L. Fudge in a letter written in March.

Fudge goes on to state that this funding would result in “mass evictions.” Among the many cuts, about 640,000 households would lose Section 8 Housing Choice Voucher assistance, and 286,000 households would lose their Project-Based Rental Assistance housing.

In response, advocates — such as the National Low-Income Housing Coalition — are urging Congress to look further than the dollar amounts, and understand the impact this will have for those in affordable housing and homelessness programs.

Strict zoning laws limited access to affordable housing, study says

A recent study reveals that strict zoning regulations favoring single-family homes contribute to limited access to affordable housing and the segregation of people based on income, race, and ethnicity.

The report by the Urban Institute, called Bringing Zoning into Focus, uses a unique database of zoning laws in Connecticut to study the impact of zoning laws on housing and segregation in the U.S. The research looks at the relationship between zoning laws, property values, and demographic and economic characteristics by analyzing data at the neighborhood level.

Because of zoning laws, only 2% of land in Connecticut permits the construction of multifamily housing, while 91% percent of the state allows single-family housing. The analysis shows that suburbs and towns have more restrictive zoning rules, while larger cities are more open to multifamily construction. Residents in areas with mostly single-family zoning are more likely to be of higher incomes, white households, college graduates, and homeowners.

With this data, the study highlights the need for policymakers to consider modifying local zoning codes to improve housing diversity and reduce segregation.